Accountancy & Taxation Services

Management Accounts

Management accounts are a crucial source of information for a business when making informed decisions and maintaining financial control.

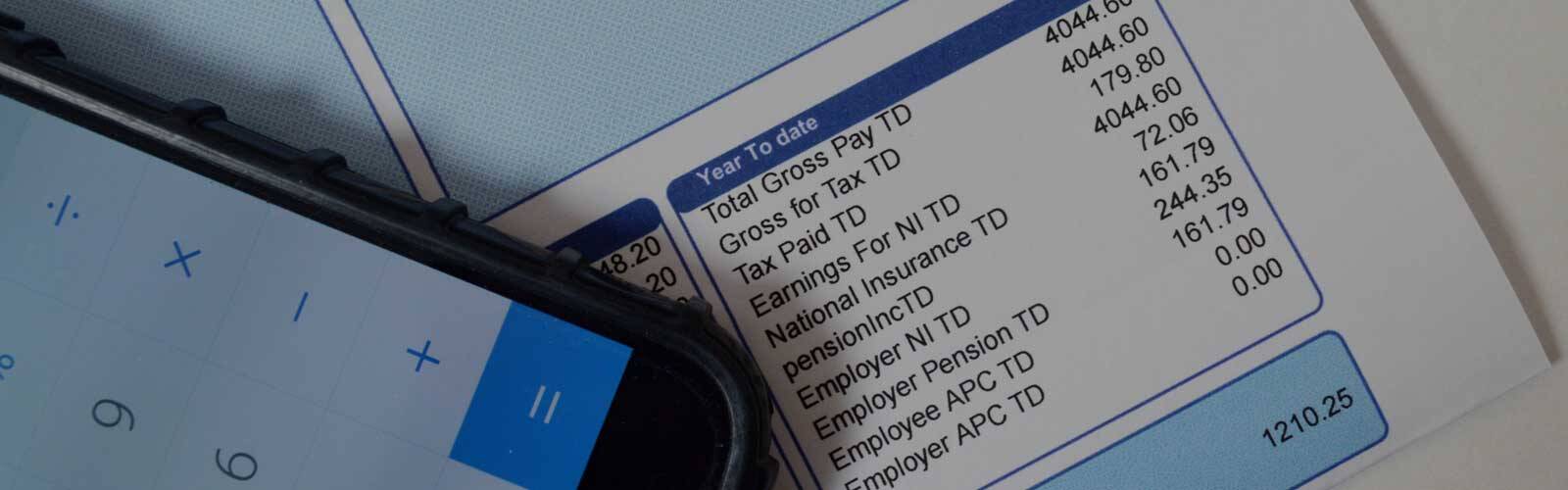

Corporation Tax

Corporation tax is a tax paid by companies on their profits, including those from all sources of income (other than dividends from UK companies) and chargeable gains.

Bookkeeping

Bookkeeping involves the daily recording and categorisation of a business’s financial transactions, while analysing and reporting them to monitor the financial performance of the business.

VAT Returns

Our team can help to ensure that your business maintains compliance with regulations by submitting returns on time, thereby avoiding overpayments and penalties.

-

Company motorbikes - a two-wheeled tax trap?

You’ve taken on a youngster as a general assistant for your business. The role includes making local deliveries for which your firm provides a motorbike. This could trigger unexpected tax and NI charges. What steps can you take to avoid them?

-

Do you need to pay tax on loyalty points and cashback?

You’ve been making business purchases on your personal credit card and reaping the rewards in the form of airmiles and cashback. What, if anything, do you need to do to keep on the right side of HMRC?

-

Can you claim input tax without a VAT invoice?

One of our clientss cannot provide a tax invoice to HMRC to support an input tax claim on the purchase of machinery three years ago. What alternative evidence should be acceptable to the officer?

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.